Tata Consultancy Services (TCS) had approved to buy back 4 crore shares through a tender offer at a price of ₹4,500 per share resulting in a total offer size of ₹18,000 crore. The record date has been fixed on February 23, 2022 for the purpose of determining the entitlement and the names of the equity shareholders who shall be eligible to participate in TCS share buyback.

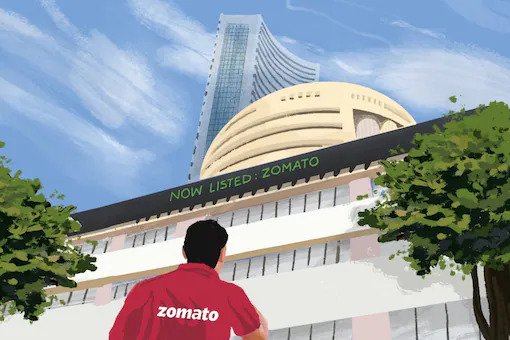

Most of the newly listed new age businesses stocks like Zomato, Paytm, Nykaa have fallen sharply from their 52 weeks high as well as from their listing or IPO issue price. In the on going market correction, the new age digital companies have been hit hard. “Since most of them, except Nykaa, cannot be valued on traditional valuation parameters, value buying on dips is not happening. Their IPO prices had no justification, but after the steep market correction, valuations are turning attractive,” Dr. VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services explained.

Shares of Zomato have more than halved from its all-time high of Rs 169.10. The stock plunged 6 per cent to hit an intraday low of Rs 77 on BSE.

HSBC Global Research in its report said that Zomato is “not for calorie-conscious customers or valuation-conscious investors.” However, the FD industry in India is about an important change to the product itself – from home-cooked to restaurant food. Which is why we think, while the long-term opportunity is real, the market may end up over-estimating growth in the near term.

Meanwhile, analysts at Ambit Capital like Zomato’s core business (food ordering, classified, Hyperpure) but concern was excess optionality built into price despite limited adjacency set vs global peers, which as per the brokerage was addressed post 41 per cent correction in stock since its Sell rating. Brokerage house Ambit Capital has changed and upgraded Zomato shares rating to ‘Buy’ from Sell on strong scale-up over next 20 years in food ordering with sustained profitability from FY27E (1-year pushback vs earlier) at 45-50 per cent market share, with a target price of Rs 106.

Similarly, shares of Nykaa (listed as FSN E-Commerce Ventures Limited) crashed 8 per cent to hit an all-time low of Rs 1,218.8 on BSE amid brutal market sell-off. The stock has tanked over 53 per cent from its all-time high. The market cap of the firm fell below Rs 62,000 crore on BSE.

Likewise, Paytm stock tanked over 3 per cent to hit an all-time low of Rs 782.30. Shares of fintech major are trading 60 per cent below its all-time high of Rs 1,961.05. The market cap of the firm slipped to Rs 51,706 crore.

Despite the ongoing scenario, the brokerage house ICICI Securities is bullish on Paytm and has a target price of Rs 1,352 per share. “On our target value of Rs 1,352 per share, Paytm is being valued at around 9.5x operating revenue largely at a slight premium to global fintech with comprehensive offering, in-line with BNPL players and at a discount to the global card network entities,” it said.

Zomato, Nykaa, Paytm: Should Investors Buy, Hold or Sell These New-Age Stocks?

Zomato, Nykaa and Paytm fell by almost 50 per cent from their 52 week-high levels. “Long term investors should hold on to their stocks as these stocks have continuously under-performed due to rich valuations, weaker global market sentiments and US Fed rate tapering. Nykaa is a profitable company and I expect it to outperform in mid to long term,” suggested Gaurav Garg, vice president-strategy & operations, CapitalVia.

Speaking on the investor strategy on Nykaa, Ashis Sarangi, SEBI registered investment advisor at Pickright Technologies, said that “Investors seeking a new entry point should hold off for a while longer, as there are many better equities available now on a risk-reward basis. Existing investors can keep their positions and wait for the price to average out.”

On Zomato, Abhay Agarwal, founder, and fund manager, Piper Serica, SEBI registered portfolio management service provider, said: “We believe that a business like Zomato, which is a long-term play on the fast-growing out-of-home food consumption market, should be considered for its long-term value creation by long-term investors. With its clear market leadership, strong balance sheet and focus on profitability we believe that it will reward long-term investors handsomely.”

Commenting on the investment strategy one should follow for Paytm, Divam Sharma, founder at Green Portfolio, SEBI registered portfolio management service provider, said: “We would suggest investors to wait for profitable growth before investing in Paytm.”

Read all the Latest News, Breaking News and Assembly Elections Live Updates here.

Reference Link:- https://www.news18.com/news/business/markets/zomato-not-for-the-calorie-concious-paytm-nykaa-shares-slump-should-you-invest-4797821.html